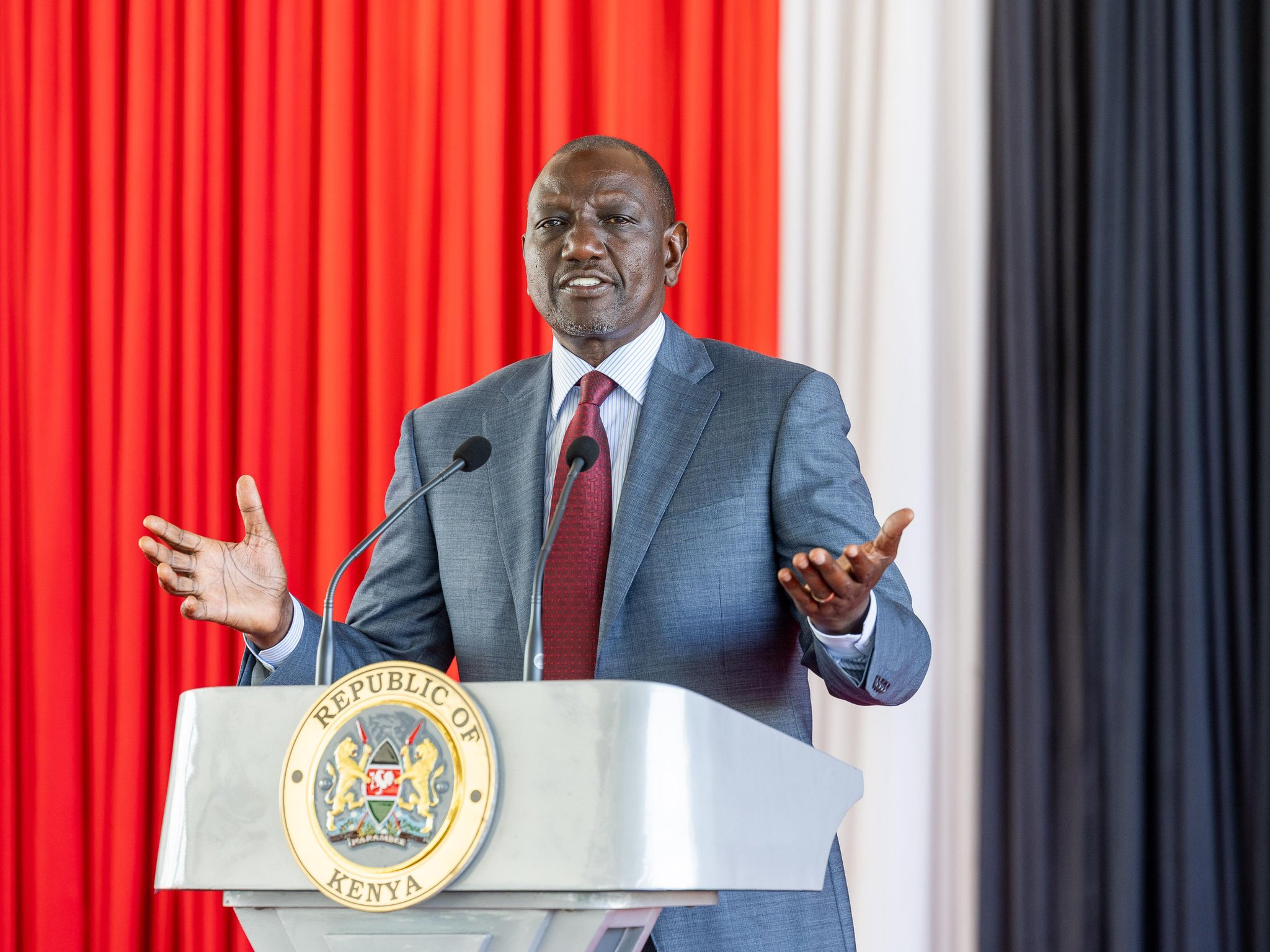

A storm is brewing across Kenya’s business landscape as prominent entrepreneur Bundotich Zedekiah Kiprop, popularly known as Buzeki, unleashes a scathing attack on President William Ruto’s UDA administration, accusing it of strangling small businesses by withholding billions in tax refunds.

In a hard-hitting statement released Saturday, Buzeki claimed that countless small and medium-sized enterprises (SMEs) are shutting down due to the government’s refusal to process long-overdue Value Added Tax (VAT) refunds.

“UDA is obsessed with collecting taxes but completely ignores the very people it squeezes them from,” he declared. “They are not reimbursing VAT claims, and SMEs are collapsing as a result.”

The shocking revelation comes as frustration deepens within the private sector. Last month, the Kenya Association of Manufacturers (KAM) raised the alarm, urging the government to set up a dedicated fund to clear the mounting VAT refund backlog. According to KAM, businesses are being crippled by the delays, with cash flow constraints derailing investments and threatening livelihoods.

Ksh800 Billion in Unpaid Bills

The situation is dire. KAM reports that the combined debts owed to private businesses by both national and county governments have skyrocketed to a staggering Ksh800 billion. The blame? Insufficient budgetary allocation to the Kenya Revenue Authority (KRA) for tax reimbursements.

And just when things couldn’t get worse, the controversial Finance Bill 2025 is proposing to slash the VAT refund claim period from 24 months to just 12. The proposed amendment to Section 17(5)(d) of the VAT Act is sending chills down the spine of many taxpaying businesses.

Previously, registered entities had two full years to file VAT refund claims after making excess payments. If the new bill passes, that window will be cut in half—an administrative nightmare for many and a potential death sentence for others.

The Clock Is Ticking

Under current law, KRA is required to review and respond to refund applications within 90 days, possibly subject to an audit. If no refund is issued within six months after the tax overpayment has been confirmed, the excess is supposed to automatically go toward settling existing or future tax liabilities.

Yet despite these legal guarantees, businesses say the funds aren’t being returned—and their patience is wearing thin.

“This isn’t just a financial crisis—it’s a betrayal,” said one Nairobi-based manufacturer. “We followed the law. We paid our taxes. Now we’re being left to drown.”

Refunds at Risk

Even in cases where taxes are mistakenly paid, the law only gives taxpayers a 12-month window to file a claim. If the new Finance Bill passes, that margin for error and correction will shrink even further.

A Nation on Edge

Buzeki’s remarks add fuel to an already fiery national debate on taxation, business survival, and government accountability.

As pressure mounts on the UDA administration, the business community and citizens alike are asking: Where is the money? And more importantly, will the government listen before more enterprises go under?

Leave a Reply