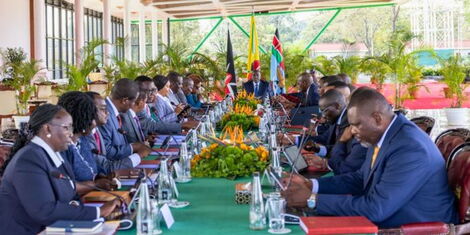

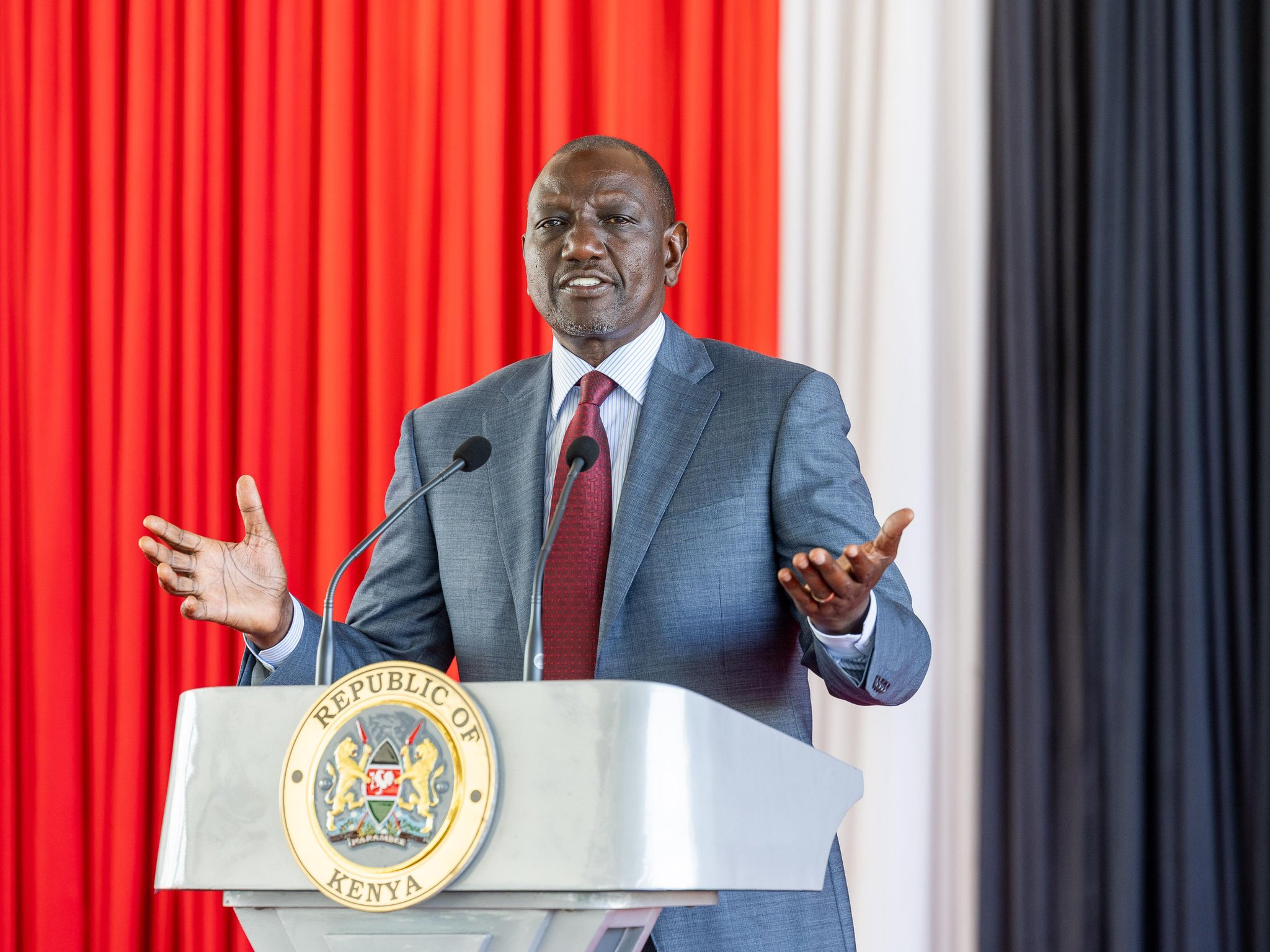

The Cabinet approved a budget of Sh4.7 trillion for the 2026/27 financial year despite revenue estimates falling short at Sh3.53 trillion. At State House, President William Ruto led a meeting that approved the budget request that analysts say will require additional borrowing to solve the increasing budget shortfall.

The new financial plan allocates Sh3.46 trillion for ongoing costs while designating Sh749.5 billion for construction work and providing almost Sh496 billion for county transfers and only Sh2 billion for emergency funds.

The government plans to deliver public services together with infrastructure projects, but the revenue situation threatens to create financial difficulties, which will result in budget problems when actual collections do not meet expectations.

The Division of Revenue Bill guarantees counties Sh420 billion as an equal share based on their audited revenues, which meets constitutional requirements. The transfer package provides support to devolved units while it creates financial strain for the national budget at a time when fiscal challenges exist.

Government officials present the budget as a strategic plan, which they describe as a movement from austerity through Bottom-Up Economic Transformation Agenda implementation until the government reaches its investment objectives. The Cabinet macroeconomic forecast predicts that GDP will grow 5.3 percent in 2026 because of beneficial weather conditions and increased agricultural yields and ongoing government reform efforts.

The critics point out that the extreme revenue projections and actual expenditure numbers create a situation that increases the chance of the government needing to obtain additional domestic and international funds, which would result in higher debt repayment costs for Kenya and decrease its financial management capabilities.

The budget now moves to Parliament, where intense scrutiny awaits as lawmakers prepare to interrogate the fiscal framework in committee hearings. The 2026/27 budget for Kenya shows both ambitious development goals and impending economic challenges because revenue targets face difficulties while spending levels remain excessively high.

Leave a Reply