Kenya’s National Treasury is reportedly planning to borrow an eye-watering KSh 102 trillion over the medium term to address what it says are massive budget deficits.

The move has shocked economic observers and raised serious concerns about how sustainable the country’s debt path can remain.Instead of relying mainly on foreign borrowing, the Treasury plans to tap domestic markets for most of the funds, according to its latest debt strategy document.

Officials say this approach will help stabilize debt exposure and protect the economy from unpredictable global events.However, critics argue that borrowing at this scale could push Kenya into a dangerous debt spiral.

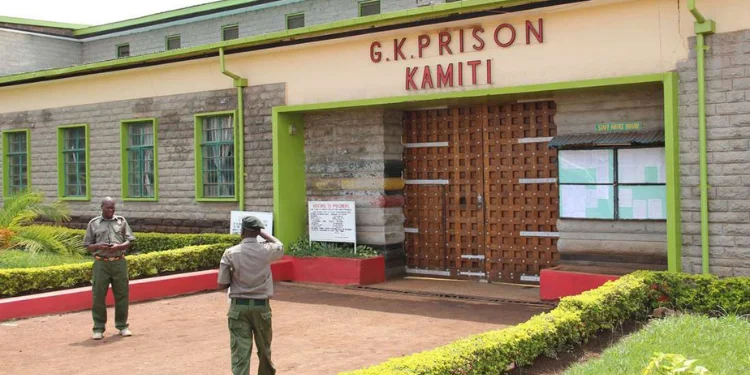

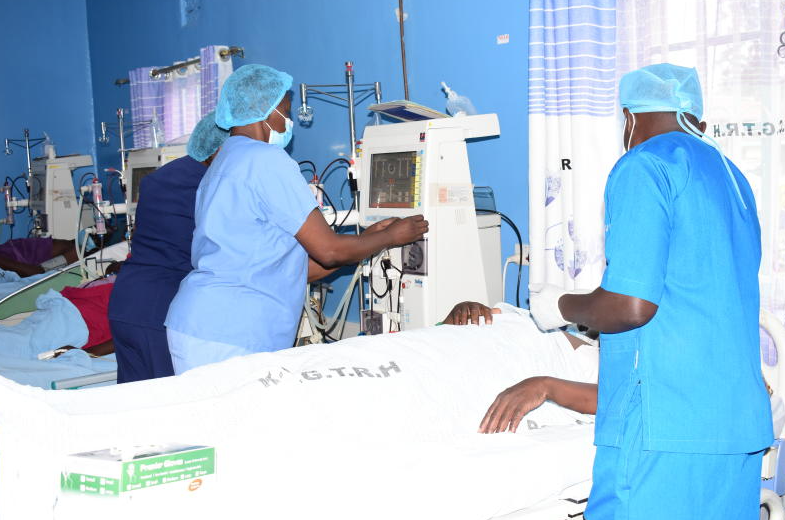

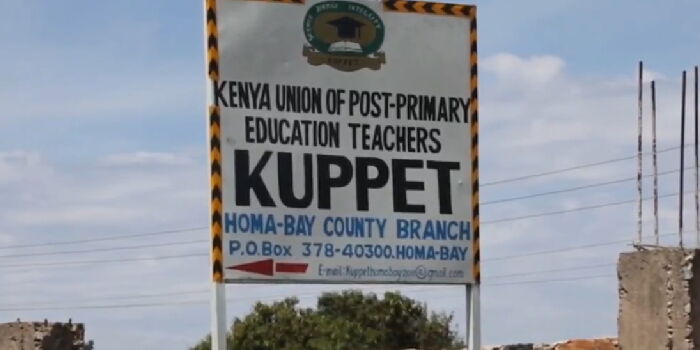

They warn that as debt increases, so will yearly repayments, potentially diverting money from essential public services such as healthcare, education, and infrastructure.There is also the risk that interest rates on government bonds will rise.

Heavy demand for financing could drive up yields, making it more expensive for the government to borrow in the future—and squeezing out private sector investment.In response to these risks, Treasury officials say they are exploring innovative debt tools, such as environmentally linked bonds and debt refinancing measures.

They argue these mechanisms will make the borrowing more manageable and aligned with long-term growth.The controversial plan is likely to dominate public and political debate in the coming weeks. If implemented, it may reshape Kenya’s financial landscape—and not just for today, but for generations to come.

Leave a Reply